Insights

By

By Lioba Reeve

Small businesses are built on speed and resourcefulness, but funding rarely moves at the same pace. Between day-to-day operations and growth planning, entrepreneurs are expected to navigate a complex landscape of programs, eligibility rules, and timelines, often without clear guidance on what is realistic or worth pursuing.

Each year, Fundica gathers input from small business owners to better understand what is holding them back. This year's results show a clear trend: funding is becoming more challenging. But they also highlight an important opportunity: when businesses can quickly identify the right programs, outcomes follow.

Who We Surveyed

This year’s findings combine responses from 293 Canadian small business owners surveyed by Fundica, along with an independent U.S. study conducted by Bredin with 300 small business respondents. Together, these findings offer a practical snapshot of how entrepreneurs experience funding today and where the support ecosystem can have the greatest impact.

Securing Funding: A Growing Challenge

Funding has always been a priority for small businesses. What is changing is how often it becomes the main barrier to progress.

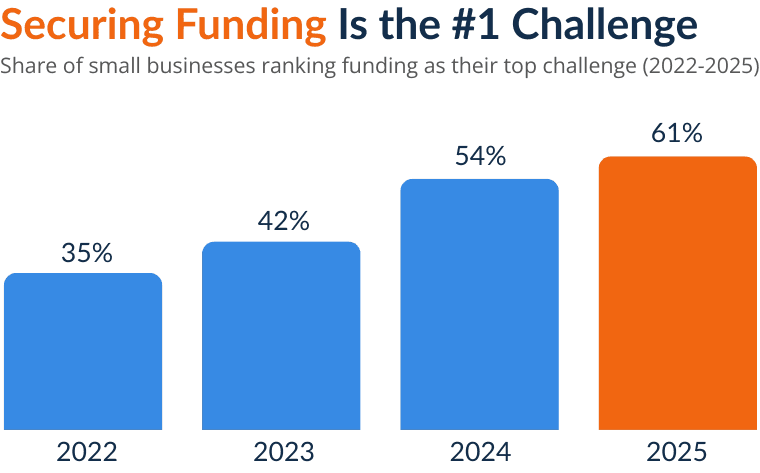

In 2025, 61% of small businesses identified securing funding as their biggest challenge, continuing a clear upward trend over the past four years.

This rise reflects more than uncertainty. It shows how difficult it has become for businesses to make confident decisions without a clear view of what funding is available, what they qualify for, and which opportunities are worth pursuing.

The Real Barrier: Funding Discovery

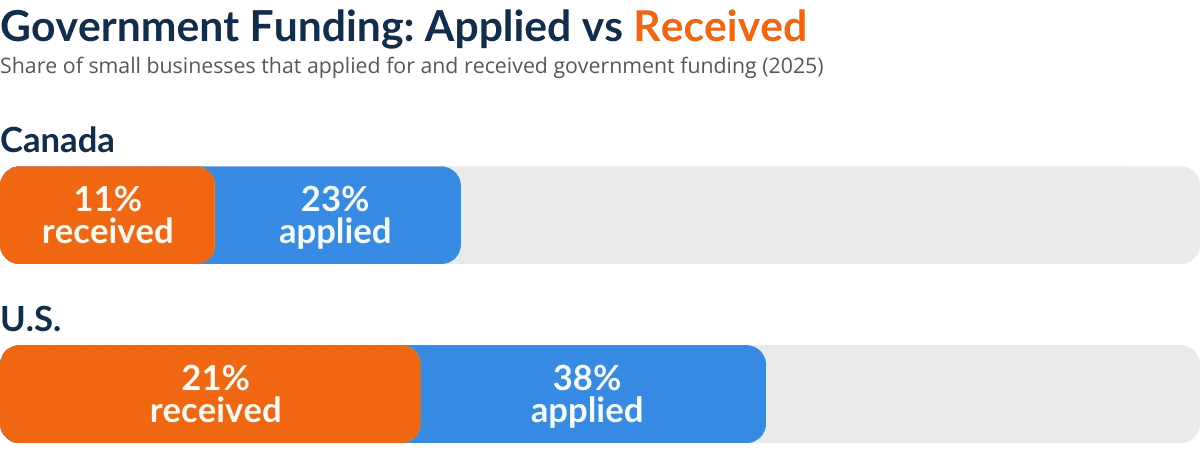

Funding is not necessarily out of reach. In fact, when businesses apply, many successfully receive government funding.

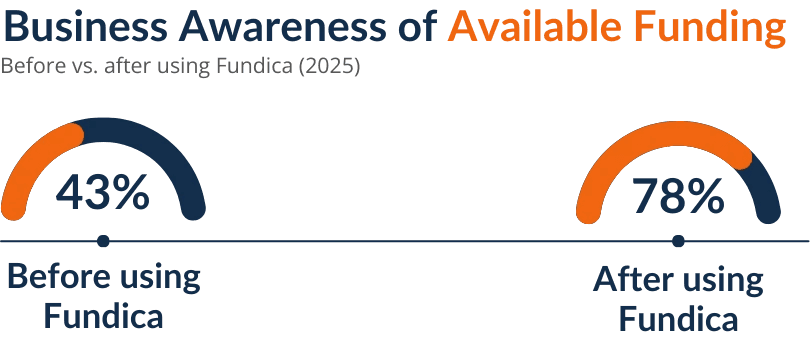

In other words, the challenge is often not funding availability, but funding navigation.

This highlights the real issue: too many businesses never apply, or they spend time pursuing programs that were never the right fit. With thousands of funding opportunities available and eligibility rules that can be difficult to interpret, it is easy to lose clarity on what is worth pursuing.

The result is missed opportunities, delayed projects, and slower growth, even when funding is available.

When Businesses Receive Funding, It Fuels Growth

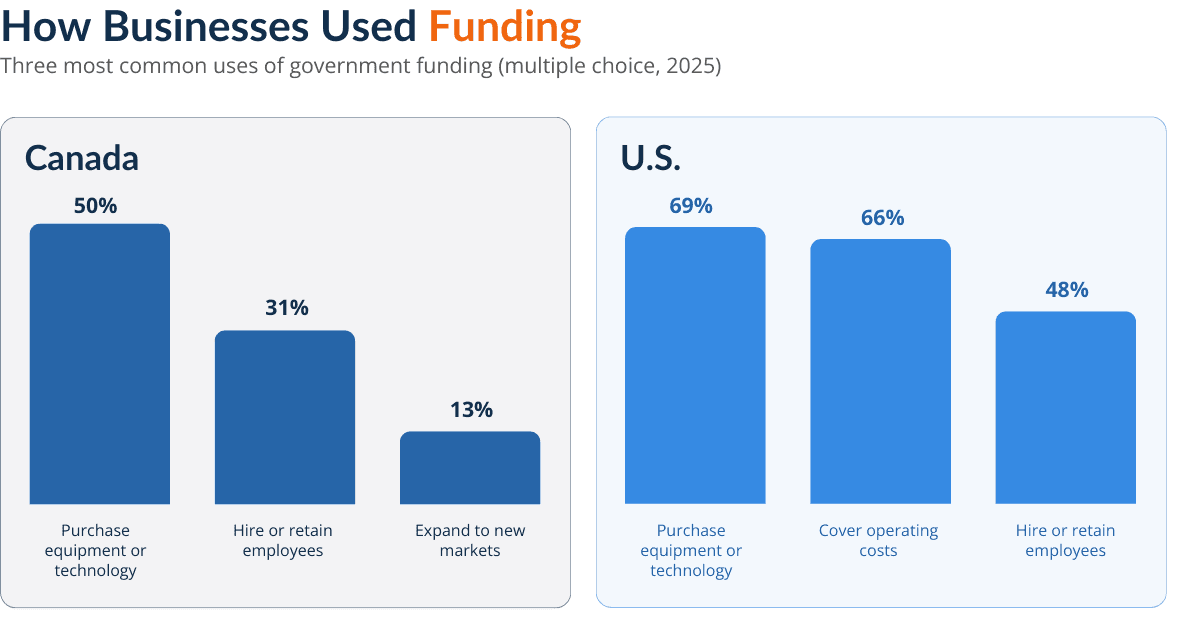

Funding supports real business decisions, from investing in new capabilities to scaling operations and entering new markets.

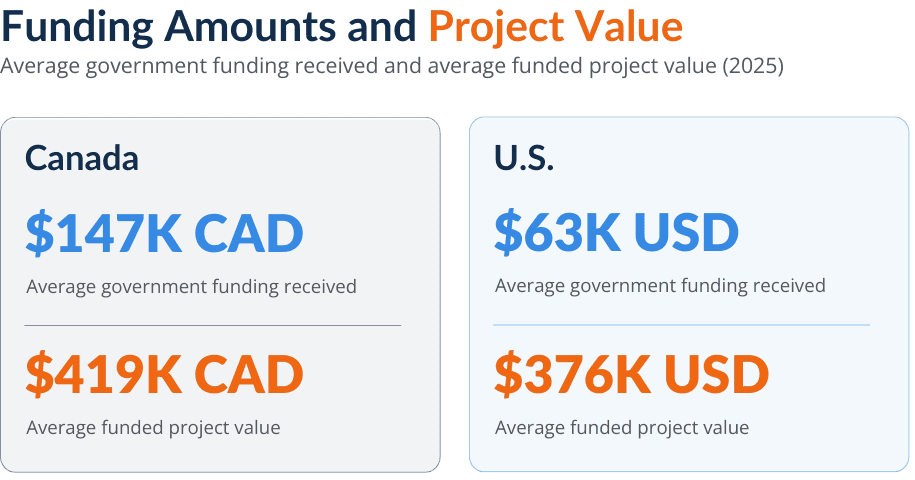

On average, Canadian businesses reported receiving $147,000 CAD in government funding, supporting projects valued at $419,500 CAD. In the U.S., businesses reported receiving an average of $62,903 USD, with an average funded project value of $375,920 USD.

While the main outcomes varied across markets, they consistently reflected the same goal: helping businesses move forward with growth-focused initiatives, whether through equipment and technology investments, hiring, or expansion.

In the U.S., funded projects were also associated with an average of 15 jobs created per project, reinforcing the broader economic impact that follows when businesses can access the right support.

What Small Businesses Value Most: Speed and Expertise

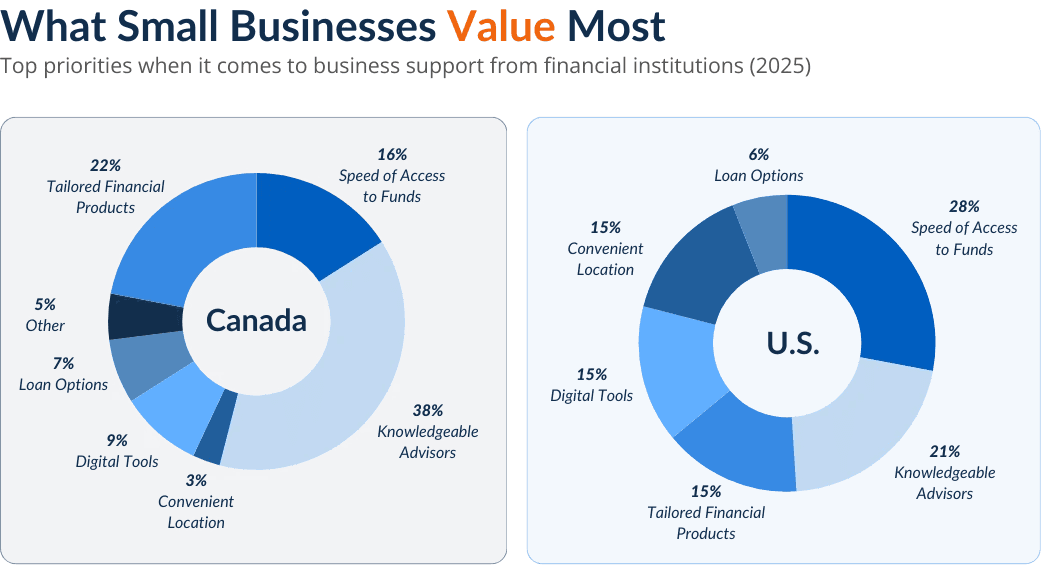

In a complex funding environment, small businesses not only compare financial products, they are also assessing the quality of support they receive.

In Canada, knowledgeable advisors ranked as the most important factor in a financial institution. In the U.S., speed of access to funding stood out as a priority.

Together, these results point to a clear expectation: small businesses want support that is both trusted and efficient. They want to move quickly, but with confidence that they are pursuing the right options.

Bridging the Funding Gap

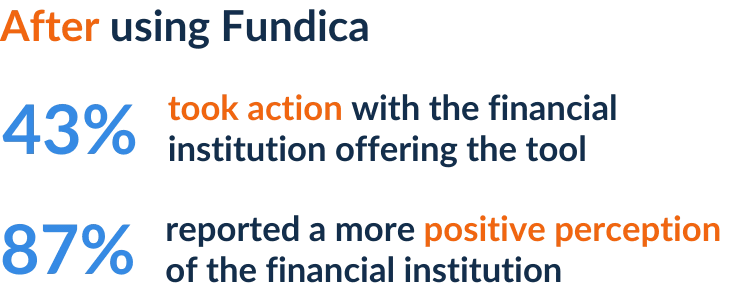

The findings are consistent across both markets: small businesses want funding, but navigating the landscape remains a major barrier. When businesses can quickly identify relevant opportunities, they are far more equipped to take the next step.

Fundica supports this through an AI-powered, white-label funding search engine that helps entrepreneur-support organizations deliver faster, more targeted funding guidance at scale, while giving small businesses clearer visibility into what they qualify for and where to start.

Clearer visibility leads to better decision-making. When businesses understand what funding is available and what applies to them, they can move forward with greater confidence.

Strengthen Your Small Business Offering

Funding is becoming a bigger challenge, but the solution is clear: make discovery easier, improve relevance, and help businesses take action sooner.

Fundica helps entrepreneur-support organizations strengthen the funding experience they provide and become a more complete, trusted source of support for the small businesses they serve. It is consistently recommended by 90% of users.

Ready to deliver a more complete funding experience to the businesses you support? Book a demo to learn how Fundica can help.