According to Marc Alloul, investor and co-founder of Budgeto, “most small business failures happen because entrepreneurs are not prepared and have not planned ahead”. Sometimes, it can seem like being ready is easier said than done, and founders, daunted by the many tasks that starting a business entails, neglect to cover their bases.

Thankfully, the internet and growing fintech space have made available a wide variety of tools that can help entrepreneurs fill gaps in their knowledge base and solve problems. Getting access to information in real-time and being able to quickly react to negative or positive events can change the game for a small business and is now much more easily done.

On the planning side, when you need forecasts to show a financing partner or to put together a plan for your business, Excel is no longer the best solution. Budgeto is an easy-to-use, affordable, and reliable online budgeting tool designed for entrepreneurs and SMBs. It is fully compatible with leading online accounting systems, and with just a few clicks creates a complete five-year plan and related financial statements based on historical data that can be tracked month-by-month. When finished, it is easy to instantly print beautiful, professional-looking PDF files or export your budget to Excel. Impress your investors and go after that funding you need to succeed.

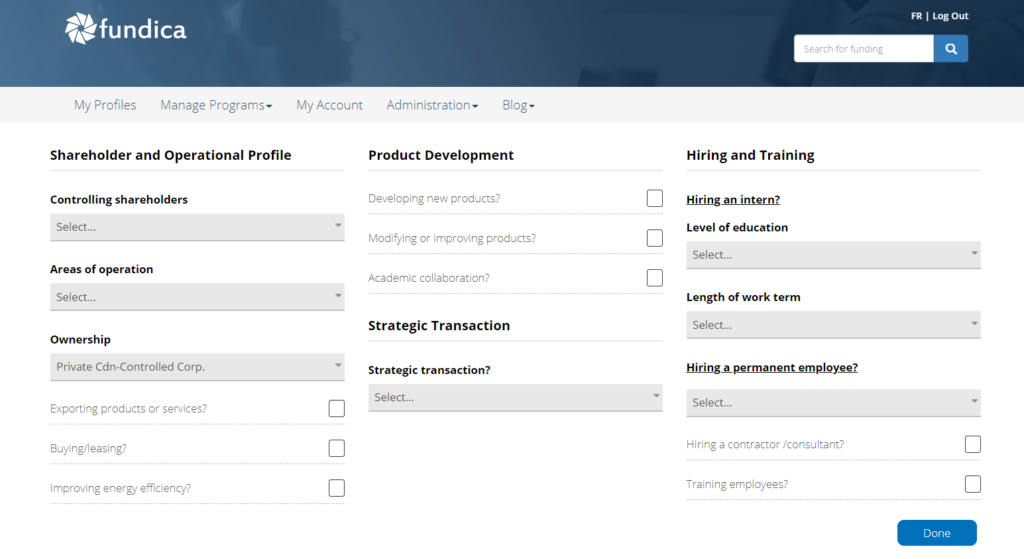

Then, with Fundica, a popular AI-powered funding tool, you can efficiently research and find the most relevant funding for your company needs and work your way through the funding process outlined below based on the forecasts you have put together. You can now easily and iteratively adjust both your funding search in Fundica and forecasts in Budgeto based on available funding and business scenarios. So taking control of your budget and accessing funding does not have to be so daunting anymore.

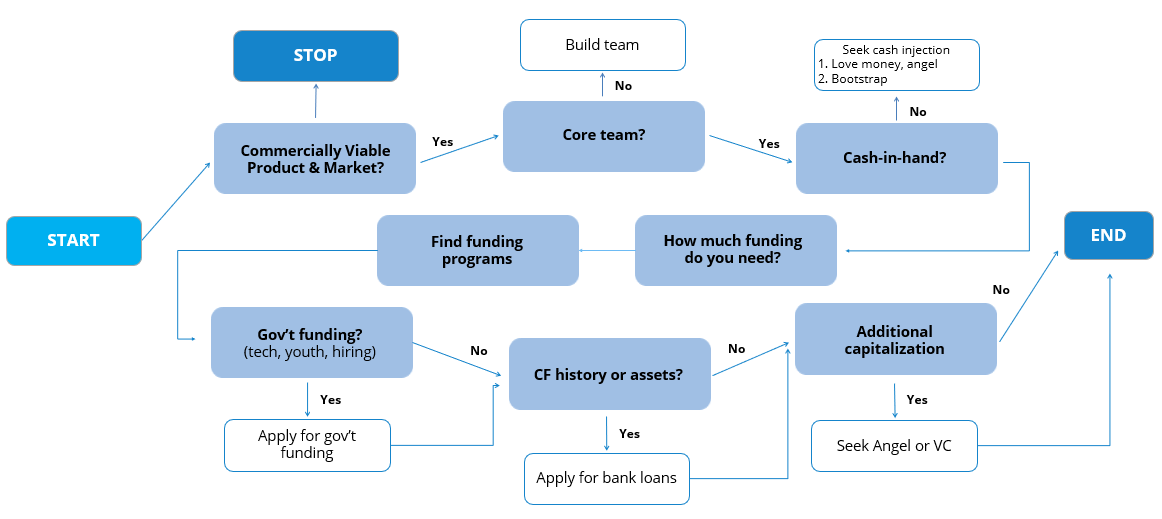

The pre-funding and funding process can appear complex at first. However, with solid knowledge of the best practices and some smart tools, you will quickly be on the right path. Here are the typical pre-funding and funding steps that we recommend for startups:

Let’s break down the steps outlined in the diagram above:

1. Make sure you have a commercially viable product. This should go without saying, but if you do not have a good product that can generate demand, you will be doing a lot of planning and fundraising for nothing. In this day and age, demand for most products can be tested very easily and inexpensively.

2. Build your core team. Before you apply for any funding programs, you should have your core team in place. This is the wisest approach to make sure you have a team to watch your back, avoid getting stuck in your own thoughts and be able to divide up the large amount of work you will likely have to do as you try to launch your business.

3. Get some early cash investments. You have a product, a team, but probably no sales. It is at this stage that you need some personal savings, bootstrapping revenue, or family and friends’ money. Unfortunately, raising money takes some time and existing funds.

4. Figure out how much you need for the business. This is where forecasting and Budgeto come in to help you analyze and visualize the funding you may require for your business. Start with one scenario and then examine alternatives, bounce them off your team, and share them with investors and advisors. Figure out how much money you need to grow your business and adjust your forecast with actual monthly results and new funding or business opportunities.

5. Find Funding. Once you have identified your current and future funding needs, you need to efficiently navigate all the funding options that are available for your business. This is where Fundica will allow you to easily identify the most relevant funding options for you based on your situation (geographic area, industries, revenues, number of employees, and more) and needs (hiring, development, training, marketing, and more). Pick the ones you want to go after and start the funding application process.

6. Apply for government funding. Working from the funding programs you identified in Fundica, you should narrow down your options and then apply for the most appropriate government programs. The key advantage of government funding is that it is often non-repayable. When it does need to be repaid, interest rates are usually low or non-existent, and the terms, in general, can be quite generous.

7. Approach traditional financial institutions. After government funding, you can start to consider regular bank loans. They can increase your liquidity, but do not forget bank loans will come with repayment terms and interest rates that you will need to factor into your budget.

8. Seek out venture capital and angel investments: Why do we recommend startups seek out VC investments last? VC capital comes with the most strings attached and requires you to give up part of your company’s equity.

It is important to follow the order of these steps, but you are not tied to getting funding from each one. For example, certain tech companies skip traditional bank funding, as they have limited assets and cash flow and go on to directly seek out equity investments earlier in their journey. It is also important to note that you may not need to get bank or equity funding, and if that is the case, your life will be that much simpler.

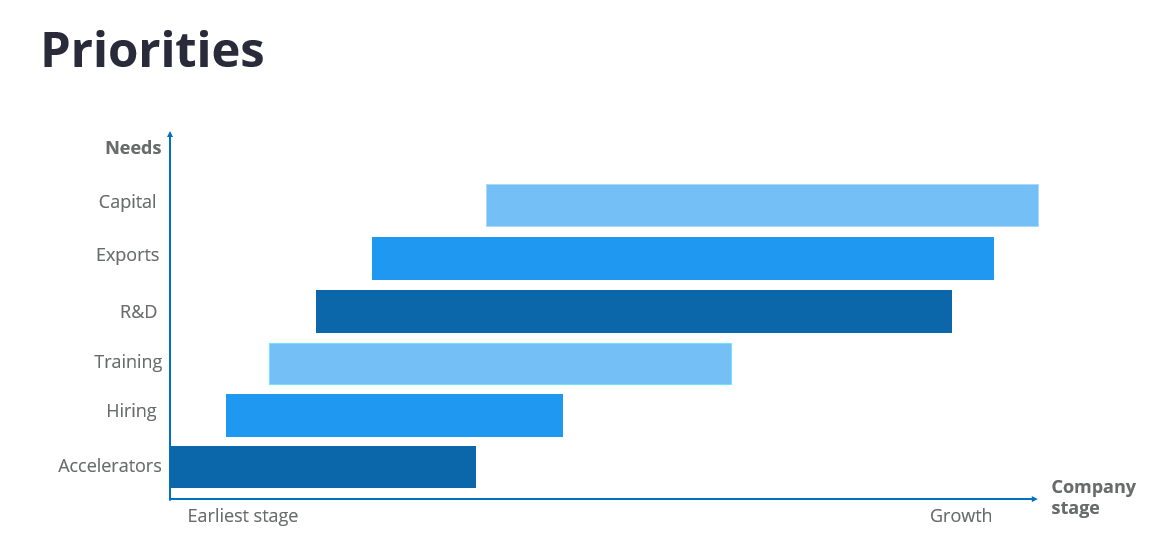

You should also plan for the use of the funding you raise when building your forecast and while you do your research. Ultimately, funds should be invested in the highest long-term priority areas first.

You can expect your funding needs to change with your company’s growth, and as such, you should be frequently revisiting your forecasts and funding options. Accelerator programs (often pre-funding) will generally be the most beneficial at the start of your journey, followed closely by hiring subsidies that will allow you to grow your team, or training programs for your existing employees. As you solidify your market, you can start looking at funding exports or capital assets.

We hope that the contents of this article will help you better manage your company’s finances independently and feel more prepared to go after the funding you need to grow your business. Please visit Budgeto to start a free trial and create your budget and fundica.com for a free account to help you find the funding you deserve.